Managing a childcare center budget effectively determines whether your program thrives or merely survives. With rising operational costs and increasing competition, childcare program administrators need a comprehensive approach to financial planning that ensures sustainability while maintaining quality care for children and families.

This guide provides childcare program administrators with practical strategies, templates, and insights to create, manage, and optimize their budgets for long-term success. You'll discover how to balance revenue streams, control expenses, and implement systems that support both financial health and educational excellence.

What is a childcare center budget and why you need one

A childcare center budget is a detailed financial plan that outlines your program's expected income and expenses over a specific period, typically monthly or annually. This essential tool helps you track cash flow, plan for seasonal variations, and ensure your program operates profitably while delivering quality care.

Creating a comprehensive budget offers several critical benefits for your childcare program:

- Financial clarity and control: A detailed budget provides clear visibility into where your money comes from and where it goes, enabling better financial decision-making.

- Improved cash flow management: Understanding your monthly revenue and expense patterns helps you prepare for slower periods and avoid cash flow shortages.

- Strategic planning capabilities: With accurate financial data, you can plan for expansion, equipment purchases, or program improvements with confidence.

- Regulatory compliance: Many licensing agencies and funding sources require detailed financial records and budgets for approval and ongoing compliance.

- Staff planning and compensation: Budget planning enables fair staff compensation while ensuring your program remains financially viable.

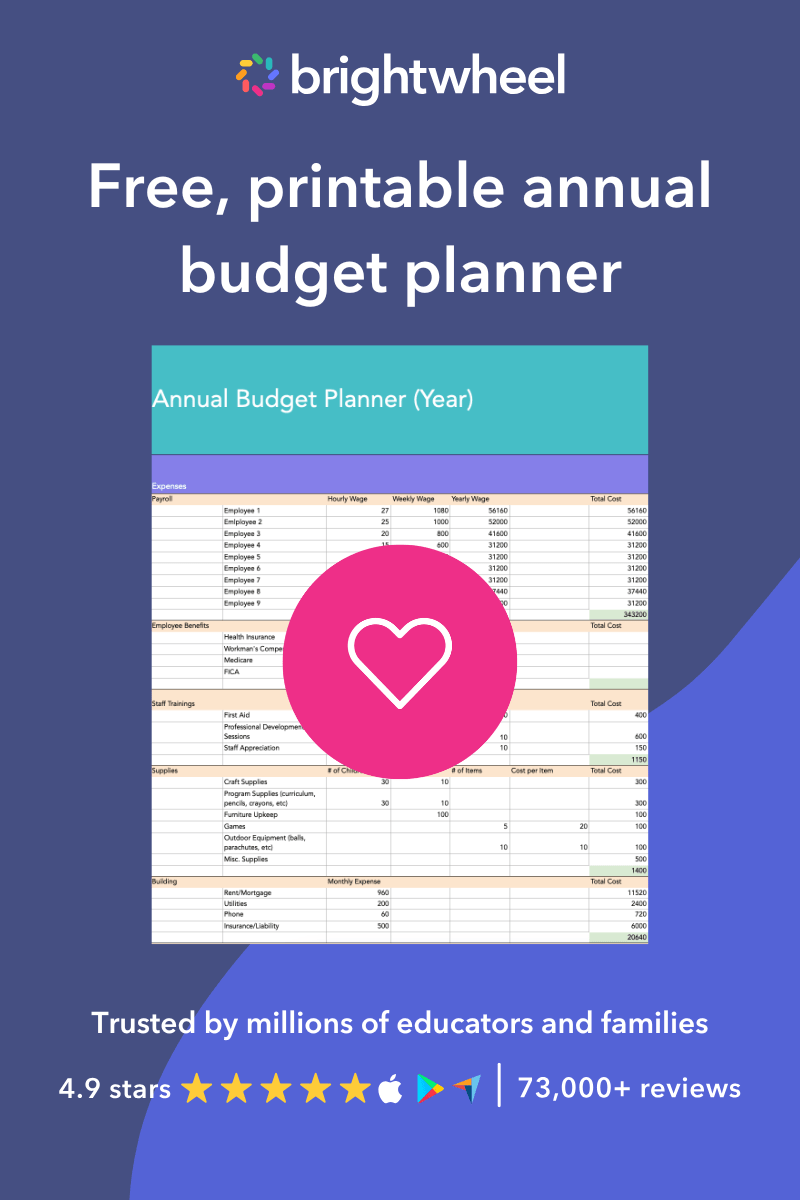

Utilizing a budget planner can streamline your center’s efficiency. Track every business expense, record your revenue, and use it to see a snapshot of your finances throughout the year.

Free, Printable Annual Budget Planner

Use this planner to create a high-level budget or business plan for your childcare center.

Essential revenue streams for your childcare program

Understanding and optimizing your revenue streams forms the foundation of a successful childcare center budget. Most programs rely on multiple income sources to maintain financial stability and growth.

A billing and payments product like brightwheel can make your billing process organized, accurate, and up-to-date with customizable billing reports that help you track every dollar with ease. Save hours each week with automated invoicing, payment notifications, and autopay, so you get paid on time, every time.

As I build my new program, the billing features are a game changer. I can easily invoice parents, and everything is automatically tracked—especially helpful come tax season.” Emily K., Owner of Emily Finzen Childcare in Lake Benton, MN

Experience Curriculum allows you to lean into creativity while following the curriculum. It’s all right there, it’s all prepared for you, and then you can lean into it.” Leinani G., Owner of Creative Minds Learning Academy in Bothell, WA

I would say that if you are a new program that you should definitely jump on brightwheel and just experience it. It’s tools that help make your life easier as the owner and director. There’s no reason not to, with the cost and the effectiveness, it’s 100% a yes for me.” Crystal D., Owner & Director at Lil’ Ranch Hands Family Childcare Home in Minco, OK

Brightwheel helps us in every way possible. From their onboarding and support team to the features that keep us organized, on track with planning, and communicating smoothly as a team to parents and each other. I couldn't imagine a better management system for our program." Harida H., Administrator at Play Pals Daycare in Maumee, OH

Tuition fees and enrollment structure

Tuition fees typically represent the majority of most childcare programs' total revenue. Setting the right tuition fees is one of the most difficult and important decisions you’ll make when starting your childcare program. The structure you choose requires balancing family affordability with operational sustainability.

Consider these tuition structures for your childcare program:

- Weekly payment structure: Many families prefer weekly payments as they align with their pay schedules.

- Monthly payment structure: Monthly payments provide more predictable cash flow for your program.

- Drop-in and hourly rates: Offering flexible care options can increase revenue during slower periods.

Additional revenue opportunities

Diversifying your income streams helps stabilize your childcare center budget during enrollment fluctuations:

- Registration and enrollment fees: One-time fees ranging from $50-$200 help cover administrative costs and demonstrate family commitment to your program.

- Late pickup fees: Charging $1-$5 per minute for late pickups encourages punctuality while compensating staff for extended hours.

- Meal and snack programs: Offering nutritious meals can generate additional revenue per child monthly while providing convenience for families.

- Summer camps and holiday programs: Specialized programs during school breaks can increase revenue by 15-20% during traditional slow periods.

- Supply fees: Annual supply fees per child help cover art supplies, cleaning materials, and educational resources.

Government funding and assistance programs

Many childcare programs supplement tuition revenue with government funding:

- Child Care Development Fund (CCDF): Federal funding that helps eligible families pay for childcare services. Childcare providers can become eligible to accept these subsidies, ensuring payment for services provided to enrolled children.

- Food programs: USDA Child and Adult Care Food Program (CACFP) provides reimbursement for nutritious meals and snacks.

- Quality improvement grants: Many states offer daycare grants for programs meeting specific quality standards or pursuing accreditation.

- Head Start partnerships: Collaborating with Head Start programs can provide stable funding for serving low-income families.

Fundraising

There are many simple and effective preschool fundraising ideas to supplement your program’s revenue and engage your community. Consider the following options:

- Launch an online fundraising campaign for specific projects, like a garden expansion or new equipment.

- Register your center with the IRS to receive donations through platforms like Facebook—just sign up with your registry, tax ID, and bank account details.

- Organize events such as yard sales, penny drives, raffles, art exhibits, talent shows, or bake sales.

These activities can boost both awareness and support for your childcare center.

Managing childcare center expenses effectively

Controlling expenses while maintaining quality care requires strategic planning and regular monitoring. Understanding your expense categories helps identify opportunities for cost savings without compromising your program's standards.

Explore software for childcare providers, like brightwheel, to stay informed of your finances with a real-time snapshot of account balances, payments, and cash flow.

Below we discuss the different expense categories you’ll encounter as a business owner.

Staff compensation and benefits

Staff costs typically represent 70-80% of a childcare program's total expenses, making this category crucial for budget management.

- Teacher salaries: Competitive salaries help attract and retain qualified staff. Budget 45-55% of total revenue for teaching staff compensation, including substitutes and support staff.

- Benefits packages: Offering health insurance, paid time off, and professional development opportunities improves retention. Budget an additional 15-20% of salary costs for comprehensive benefits.

- Professional development: Investing $500-$1,000 per teacher annually in training and continuing education improves quality while meeting licensing requirements.

Facility and operational costs

Physical space and operational expenses form the second-largest budget category. Many of these costs may be tax-deductible as business expenses. We recommend consulting a tax professional to understand what applies to your specific situation.:

- Rent or mortgage payments: Facility costs should not exceed 15-20% of total revenue. Consider location, safety features, and expansion possibilities when evaluating space costs.

- Utilities and maintenance: Budget 3-5% of revenue for utilities, routine maintenance, and repairs. Energy-efficient improvements often reduce long-term costs.

- Insurance coverage: Comprehensive liability, property, and vehicle insurance typically costs $3,000-$8,000 annually depending on enrollment and coverage levels.

- Licensing and regulatory fees: Annual licensing fees, background checks, and regulatory compliance costs vary by state but typically range from $500-$2,500 annually.

Educational supplies and equipment

Quality educational materials support your program's mission while representing a significant budget category:

- Curriculum materials: Set aside a budget for age-appropriate educational materials, books, and learning resources for each child.

- Toys and equipment: Factor in the initial investment for durable, safe toys and playground equipment, as well as annual replacement costs.

- Technology integration: If you plan to use educational tablets, software, or other digital learning tools, budget for licensing, updates, and maintenance.

Seasonal expense planning

Many childcare program expenses fluctuate throughout the year:

- Summer increases: Air conditioning, outdoor activities, and increased water usage can raise utility costs by 20-30% during summer months.

- Holiday programming: Special events, decorations, and seasonal activities may require additional budget allocation of $10-$25 per child.

- Back-to-school preparation: Classroom setup, new materials, and marketing efforts often require increased spending in late summer.

Sample childcare center budget breakdown

Understanding realistic budget proportions helps childcare program administrators create sustainable financial plans. This sample budget reflects industry standards for a 50-child program generating $450,000 in annual revenue.

Revenue breakdown

- Tuition fees: $405,000 (90%)

- Registration fees: $15,000 (3.3%)

- Food program reimbursement: $18,000 (4%)

- Additional services: $12,000 (2.7%)

- Total Annual Revenue: $450,000

Expense allocation

- Staff compensation and benefits: $292,500 (65%)

- Facility costs (rent/utilities): $67,500 (15%)

- Food and supplies: $31,500 (7%)

- Insurance and licensing: $13,500 (3%)

- Equipment and maintenance: $18,000 (4%)

- Marketing and administration: $9,000 (2%)

- Professional development: $4,500 (1%)

- Emergency fund allocation: $4,500 (1%)

- Total Annual Expenses: $441,000

Profit margin calculation

- Net Profit: $9,000 (2%)

- Monthly Cash Flow: $750

This sample demonstrates a lean but sustainable budget with a modest profit margin. Childcare programs generally operate with low profit margins, often around 1%. Higher margins allow for program expansion and quality improvements.

Step-by-step childcare center budget creation process

Creating an effective childcare center budget requires systematic planning and attention to detail. Follow these steps to develop a comprehensive financial plan for your program.

Step 1: Analyze your current enrollment and capacity

Begin by assessing your current enrollment patterns and maximum capacity:

- Document current enrollment: Track enrollment by age group, as infant care typically commands higher fees than preschool programs.

- Calculate capacity utilization: Determine your occupancy rate by dividing current enrollment by licensed capacity. Rates above 90% indicate strong demand but limited flexibility.

- Project enrollment trends: Consider seasonal patterns, community growth, and competition when forecasting future enrollment levels.

Step 2: Research local market rates

Understanding your local market ensures competitive yet sustainable pricing:

- Survey competitor pricing: Research tuition rates at similar programs within a five-mile radius of your location.

- Analyze value propositions: Compare services offered, hours of operation, and program quality to justify your pricing structure.

- Consider family demographics: Ensure your rates align with local family income levels while covering operational costs.

Step 3: Calculate fixed and variable expenses

Categorize all expenses to understand your cost structure:

- Fixed expenses: Rent, insurance, licensing fees, and base staff salaries remain constant regardless of enrollment levels.

- Variable expenses: Food costs, supplies, and substitute staff expenses fluctuate with enrollment and program activities.

- Seasonal variations: Account for higher utility costs in summer and winter, increased marketing during enrollment periods, and holiday program expenses.

Step 4: Implement monitoring systems

Regular budget monitoring prevents financial problems before they impact your program:

- Monthly financial reviews: Compare actual income and expenses to budgeted amounts, identifying variances early.

- Cash flow projections: Maintain three-month rolling cash flow projections to anticipate and prepare for financial challenges.

- Key performance indicators: Track metrics like cost per child, revenue per enrolled child, and staff turnover rates.

Step 5: Plan for contingencies

Prepare for unexpected events that could impact your financial stability:

- Emergency fund: Maintain reserves equal to 2-3 months of operating expenses for unexpected repairs, equipment replacement, or enrollment drops.

- Insurance coverage: Ensure adequate coverage for liability, property damage, and business interruption.

- Alternative revenue plans: Develop strategies for generating income during temporary closures or reduced capacity situations.

Budget planning for new childcare programs

Starting a new childcare program requires careful financial planning and realistic projections. New programs face unique challenges including initial equipment investments, marketing costs, and gradual enrollment growth.

Startup capital requirements

New childcare programs typically need substantial initial investment:

- Facility preparation: Renovation, safety modifications, and licensing compliance can cost $15,000-$50,000 depending on space requirements.

- Initial equipment and supplies: Furniture, toys, educational materials, and safety equipment require $200-$400 per child capacity for quality items.

- Operating capital: Maintain 6-12 months of operating expenses as working capital since enrollment builds gradually over time.

Enrollment growth projections

Most new programs experience gradual enrollment growth:

- Month 1-3: Expect 20-30% of capacity as families learn about your program and build trust.

- Month 4-8: Growth typically increases to 60-70% of capacity as word-of-mouth referrals increase.

- Month 9-12: Mature programs often reach 85-95% capacity, though this varies by location and competition.

Marketing and community outreach

New programs require dedicated marketing budgets:

- Grand opening events: Budget $2,000-$5,000 for community open houses, promotional materials, and local advertising.

- Digital marketing: Website development, social media management, and online advertising typically cost $500-$1,500 monthly.

- Community partnerships: Developing relationships with pediatricians, elementary schools, and family organizations requires time and minimal financial investment but yields significant enrollment benefits.

Technology costs and ROI calculation

Modern childcare programs increasingly rely on technology to streamline operations and enhance family communication. Understanding technology costs and benefits helps optimize your childcare center budget allocation.

Essential technology investments

- Management software: All-in-one childcare management software like brightwheel come with a monthly cost but can save 20+ administrative hours weekly through automated billing, communication, and record keeping.

- Communication systems: Parent communication apps improve satisfaction and reduce administrative phone calls. Calculate ROI by comparing monthly software costs to staff time savings.

- Security systems: Digital check-in/check-out systems and security cameras enhance safety while reducing liability insurance costs.

- Educational technology: Tablets, learning software, and digital curricula can enhance educational outcomes while requiring annual budget allocation per child.

Calculating technology return on investment

Evaluate technology investments by comparing costs to benefits:

- Time savings: If childcare management software saves 20 hours monthly at $15/hour labor cost, the monthly value equals $300. Software costing $200 monthly provides positive ROI.

- Payment processing: Automated billing systems that improve on-time payments from 70% to 90% can significantly improve cash flow and reduce collection efforts.

- Family satisfaction: Technology that enhances communication and convenience can reduce turnover, saving recruitment and onboarding costs per family.

FAQ

Why do you need a childcare budget plan?

A childcare budget plan is essential for maintaining the financial health and sustainability of your program. It helps you track and allocate funds effectively, ensuring operational costs such as staff salaries, facility maintenance, and educational supplies are covered without strain.

A well-structured budget also provides insights into potential areas of improvement, supports long-term planning, and prepares your program for unexpected expenses. Additionally, it fosters transparency with staff and families, building trust and confidence in your program's stability and commitment to quality care.

How often should I review and update my childcare center budget?

Review your budget monthly to compare actual performance against projections. Update annual budgets quarterly to reflect enrollment changes, expense variations, and market conditions. Major budget revisions should occur annually during strategic planning processes.

How do I handle seasonal enrollment fluctuations in my budget?

Plan for seasonal variations by maintaining higher cash reserves during strong enrollment periods. Consider offering summer camps, holiday programs, or partnerships with local schools to maintain revenue during traditional slow periods.

How do you claim daycare expenses on your taxes?

Consult with a business accountant or tax professional to claim daycare expenses on your taxes. Getting your registered tax agent or tax attorney to help with your filing will ensure that your forms are filed correctly and that you’re maximizing all of the benefits from your state-specific expenses.

The amount you pay in salaries, benefits, and operating expenses counts as deductible business costs for corporations, regardless of where your daycare is located. Then, you’ll need to pay a corporate tax based on your daycare's profit at the end of the year.

Daycare expenses for sole proprietors can be deducted under Schedule C. Furthermore, if your daycare business is located in specific areas of your home, a portion of your housing cost such as a mortgage or rent payment, can be deducted as an expense from your taxes. However, you can only deduct the portion of your home used for your childcare business.

The items you can claim as deductions will vary from state to state, so check your state's website for more information on the income tax deductions that apply to you. The IRS also has a comprehensive list of what can and can’t be deducted.

How do I determine appropriate tuition rates for my market?

Research local competitor rates, analyze your cost structure, and consider family income levels in your service area. Your rates should cover all expenses while providing modest profit margins for sustainability and growth.

How can I make a daycare balance sheet template for my daycare business?

Creating a daycare balance sheet template is key for financial management. Organize your finances into three sections:

- Assets: Cash, bank balances, equipment, unpaid fees.

- Liabilities: Loans, bills, payroll, rent.

- Equity: Your ownership (Assets - Liabilities).

Use spreadsheet software, such as Excel or Google Sheets, to structure your template. Include columns for each account type, and create equations to automatically calculate totals for assets, liabilities, and equity.

Taking action on your childcare center budget

A well-structured childcare center budget is essential for the success and sustainability of your business. By maintaining an accurate budget, you can identify areas for cost savings, make informed decisions about investments, and ensure consistent quality in your services.

With proper financial planning, you can focus more time on providing quality care and growing your business confidently.