One of the most powerful tools for understanding and improving your program's financial performance is the income statement. Daycare income statements provide a comprehensive snapshot of your revenue and expenses over a specific period, helping you identify trends, make informed decisions, and plan for growth.

Whether you're opening a new center, expanding to multiple locations, or simply looking to improve your bottom line, mastering income statements is essential for success. In this article, we will explore what income statements are, why they are important to childcare programs, as well as different options available to your business.

Table of contents

- Understanding daycare income statements

- What is the difference between a balance sheet and an income statement?

- Key components of childcare program financials

- How brightwheel simplifies financial management

- How to track expenses for your childcare program

- Daycare income statement examples

- Common mistakes in daycare income statement preparation

- When to seek professional help with your financials

- How often should childcare programs review income statements

- Tax implications of daycare income statements

- Frequently asked questions

Understanding daycare income statements

A daycare income statement, also called a profit and loss (P&L) statement, summarizes your childcare program's financial performance over a specific time period. It shows all revenue coming into your program and all expenses going out, with the difference representing your net income or loss.

Why are they important for childcare programs?

Income statements serve several critical functions for childcare programs:

- Track profitability: They reveal whether your program is making money, breaking even, or operating at a loss. This information helps you understand if your current tuition rates and enrollment levels support sustainable operations.

- Identify cost patterns: By reviewing income statements over time, you can spot trends in expenses. For example, you might notice that supply costs spike at the beginning of each school year or that utility expenses increase during summer months.

- Support strategic planning: Income statements provide the data you need to make informed decisions about staffing levels, facility improvements, program offerings, and tuition adjustments.

- Facilitate loan applications: Banks and investors require income statements when evaluating loan applications or investment opportunities. A well-prepared statement demonstrates financial responsibility and business viability.

- Inform tax preparation: Your income statement serves as the foundation for tax filings, ensuring you accurately report income and claim all eligible deductions.

What is the difference between a balance sheet and an income statement?

Your daycare income statement complements the balance sheet of your business. The balance sheet shows your assets, liabilities, and equity at a specific point in time. An income statement on the other hand, will reflect your revenue, expenses, gains, and losses in more detail and over a longer period of time. Together a balance sheet and an income statement will provide you with an overview of the financial health of your daycare business.

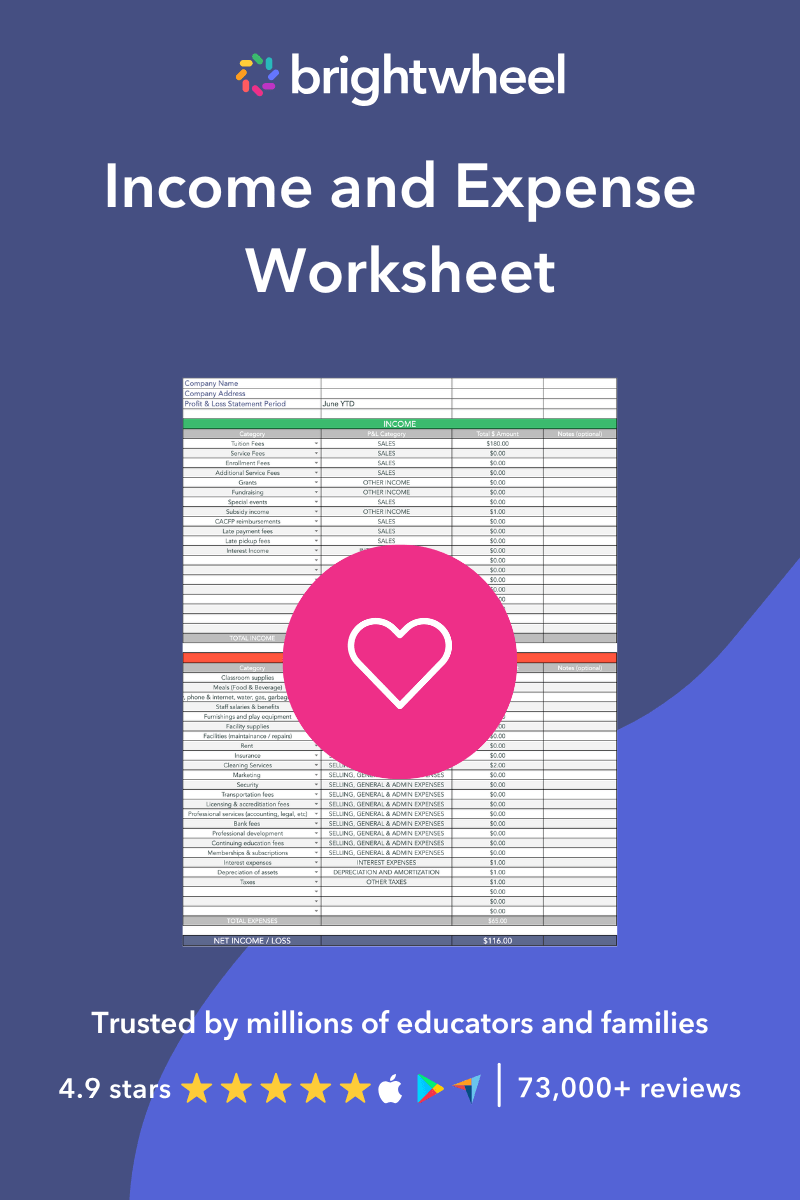

Income and Expense Worksheet

Use this worksheet to track your finances, make smarter spending decisions, and create a monthly budget.

Key components of childcare program financials

Every daycare income statement includes three main sections: revenue, expenses, and net income.

Revenue

Revenue represents all money flowing into your childcare program. Common revenue sources include:

- Tuition fees: The primary income source for most programs, including full-time, part-time, and drop-in care

- Registration and enrollment fees: One-time charges when families join your program

- Government subsidies: Payments from state or federal programs that help families afford childcare

- Grants: Funding from foundations, government agencies, or other organizations

- Late pickup fees: Charges assessed when families pick up children after closing time

- Activity fees: Additional charges for special programs, field trips, or extracurricular activities

Brightwheel’s billing product for childcare providers can support you in this process, helping you record your different revenue streams.

Expenses

Expenses represent all costs associated with running your childcare program. Major expense categories include:

- Staff salaries and benefits: Typically the largest expense, including wages, health insurance, retirement contributions, and payroll taxes

- Facility costs: Rent or mortgage payments, property insurance, maintenance, and repairs

- Utilities: Electricity, water, gas, internet, and phone services

- Supplies and materials: Curriculum materials, art supplies, cleaning products, and office supplies

- Food costs: Meals, snacks, and kitchen supplies

- Licensing and insurance: State licensing fees, liability insurance, and other regulatory costs

- Marketing and advertising: Website maintenance, social media ads, and promotional materials

- Professional development: Training workshops, conferences, and certifications for staff

Net income

Net income is calculated by subtracting total expenses from total revenue. A positive number indicates profit, while a negative number reveals a loss. This bottom-line figure is the ultimate measure of your program's financial health.

How brightwheel simplifies financial management

Brightwheel offers an automated, all-in-one billing solution designed to streamline financial management for childcare providers. With features like recurring invoices, autopay options, and seamless online payment processing, it helps reduce the time spent on administrative tasks while increasing on-time payments.

Providers can track tuition payments, fees, and other revenue streams in real-time, ensuring clear visibility into their financial health. Brightwheel’s customizable billing setup also supports splitting invoices and applying specific discounts, catering to the unique needs of families. By simplifying these processes, childcare providers can spend less time managing finances and more time focusing on delivering exceptional care and education.

How to track expenses for your childcare program

Accurate expense tracking is essential for creating reliable income statements. Here are two approaches:

Software solutions

Modern childcare management platforms like brightwheel offer integrated financial tracking tools that automatically categorize expenses, generate reports, and connect with accounting software. These solutions save hours monthly by eliminating manual data entry and reducing errors.

Benefits of software-based tracking include:

- Automatic categorization of transactions

- Real-time financial reporting

- Integration with autopay and billing systems

- Multi-location expense tracking

- Secure cloud storage of financial records

Manual tracking methods

Smaller programs may prefer manual tracking using spreadsheets or basic accounting software. This approach requires more time but offers complete control over categorization and reporting.

Best practices for manual tracking:

- Create separate accounts for different expense categories

- Save all receipts and invoices

- Record transactions weekly to avoid falling behind

- Reconcile bank statements monthly

- Use consistent naming conventions for expense categories

Daycare income statement examples

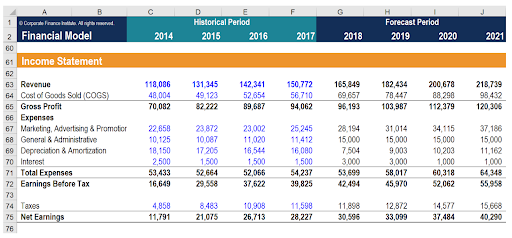

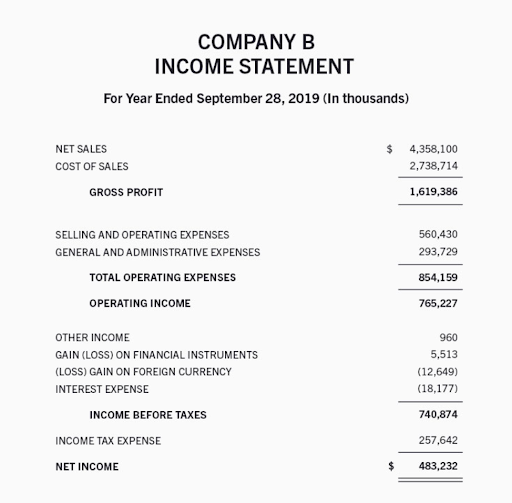

Below are two income statement examples, to give you an idea of what they entail and how you might apply them to your business.

Source: CFI’s Financial Modeling Courses

Source: Harvard Business School online

You can also download a free daycare income and expense worksheet template here.

Common mistakes in daycare income statement preparation

Avoiding these errors will ensure your income statements provide accurate financial insights:

- Incorrect categorization: Mixing operating expenses with capital expenses or misclassifying transactions can distort your financial picture. For example, purchasing playground equipment is a capital expense, not a regular supply cost.

- Neglecting all income sources: Failing to record registration fees, late pickup charges, or other supplementary revenue creates an incomplete financial picture.

- Inconsistent time periods: Comparing a three-month statement to a six-month statement without adjusting for the difference leads to false conclusions about financial performance.

- Ignoring accrued expenses: Some expenses, like annual insurance premiums, should be allocated across the months they cover rather than recorded entirely in the month paid.

- Missing transactions: Incomplete records due to lost receipts or delayed data entry compromise the accuracy of your statements.

When to seek professional help with your financials

While many childcare program directors can manage their own income statements, certain situations call for professional assistance:

- Financial difficulties: If your program consistently operates at a loss or struggles with cash flow, a financial consultant can identify problems and recommend solutions.

- Loan or investment applications: Banks and investors expect professionally prepared financial statements. An accountant ensures your documents meet industry standards and present your program favorably.

- Tax complications: Programs with complex funding sources, multiple locations, or significant deductions benefit from professional tax preparation to maximize savings and ensure compliance.

- Rapid growth: Expanding to new locations or significantly increasing enrollment creates financial complexity that may exceed your internal capabilities.

- Audit requirements: Some grants and contracts require independent financial audits, which must be conducted by licensed professionals.

How often should childcare programs review income statements

The frequency of income statement review depends on your program's size, complexity, and goals:

- Monthly: Review monthly statements to catch problems early, track progress toward financial goals, and make timely adjustments to operations. This frequency is ideal for programs experiencing financial challenges or pursuing growth.

- Quarterly: Quarterly reviews provide sufficient oversight for stable programs while reducing administrative burden. This schedule works well for established programs with predictable enrollment and expenses.

- Annually: At minimum, prepare annual income statements for tax filing, strategic planning, and year-over-year performance comparison. Even programs that review monthly or quarterly should create comprehensive annual summaries.

Many successful programs use a combination approach: quick monthly reviews to spot anomalies, detailed quarterly analysis to evaluate trends, and comprehensive annual reviews for strategic planning.

Tax implications of daycare income statements

Your income statement directly informs your tax filings and affects your tax liability.

- Deductible expenses: Virtually all legitimate business expenses on your income statement reduce your taxable income. Common deductions include staff salaries, rent, utilities, supplies, insurance, and professional development costs.

- Depreciation: Large purchases like furniture, playground equipment, and computers can be depreciated over several years, providing ongoing tax benefits beyond the purchase year.

- Subsidy income reporting: Government subsidies count as taxable income and must be accurately reported. Keep detailed records of subsidy payments separated from tuition revenue.

- Home-based programs: Providers operating from their homes can deduct a portion of household expenses like mortgage interest, utilities, and repairs based on the percentage of space used for childcare.

Frequently asked questions

How often should I prepare daycare income statements?

At minimum, prepare statements monthly for internal management and annually for taxes and strategic planning. Many programs find quarterly statements provide the right balance of oversight and efficiency.

How do I handle seasonal fluctuations in my income statement?

Compare each month to the same month in previous years rather than to the previous month. This year-over-year comparison accounts for predictable seasonal patterns like summer enrollment changes or holiday closures.

What is the best way to improve on-time payments for my childcare program?

Implementing an automated billing system with autopay options is the most effective way to ensure on-time payments. Tools like brightwheel allow parents to set up recurring payments, send reminders for upcoming due dates, and provide transparent invoices, reducing the risk of delays.

A roadmap to financial success

Understanding your daycare’s income statements helps you make smarter decisions, spot chances to improve, and build a program that lasts. When you track your income and expenses correctly, check your statements often, and use what you learn to plan, financial management can shift from being a source of stress to a tool for success.