Opening a childcare program brings immense rewards, but the first year often presents significant financial challenges. Many new providers underestimate startup costs or struggle with unpredictable cash flow during those crucial early months. Without proper financial planning, even the most passionate childcare providers can find themselves overwhelmed by unexpected expenses or revenue shortfalls.

Creating a comprehensive daycare startup budget is essential for long-term success. A well-structured budget template helps you anticipate costs, plan for contingencies, and make informed decisions about your childcare program.

This article will walk you through every component of first-year budgeting, from initial licensing fees to ongoing operational expenses, ensuring your program starts on solid financial ground.

Creating a daycare startup budget template

A successful daycare startup budget requires careful organization and regular monitoring. Your budget template should include five key components: startup costs, monthly recurring expenses, revenue projections, cash flow tracking, and emergency reserves.

Using spreadsheet software like Google Sheets or Excel makes budget management straightforward and accessible. Create separate tabs for different budget categories, allowing you to track expenses and income with precision. Include columns for projected amounts, actual expenses, and variance analysis to identify areas where you're over or under budget.

Consider downloading a specialized daycare budget template designed specifically for childcare providers. These templates include industry-specific expense categories and revenue streams that generic business budgets might miss.

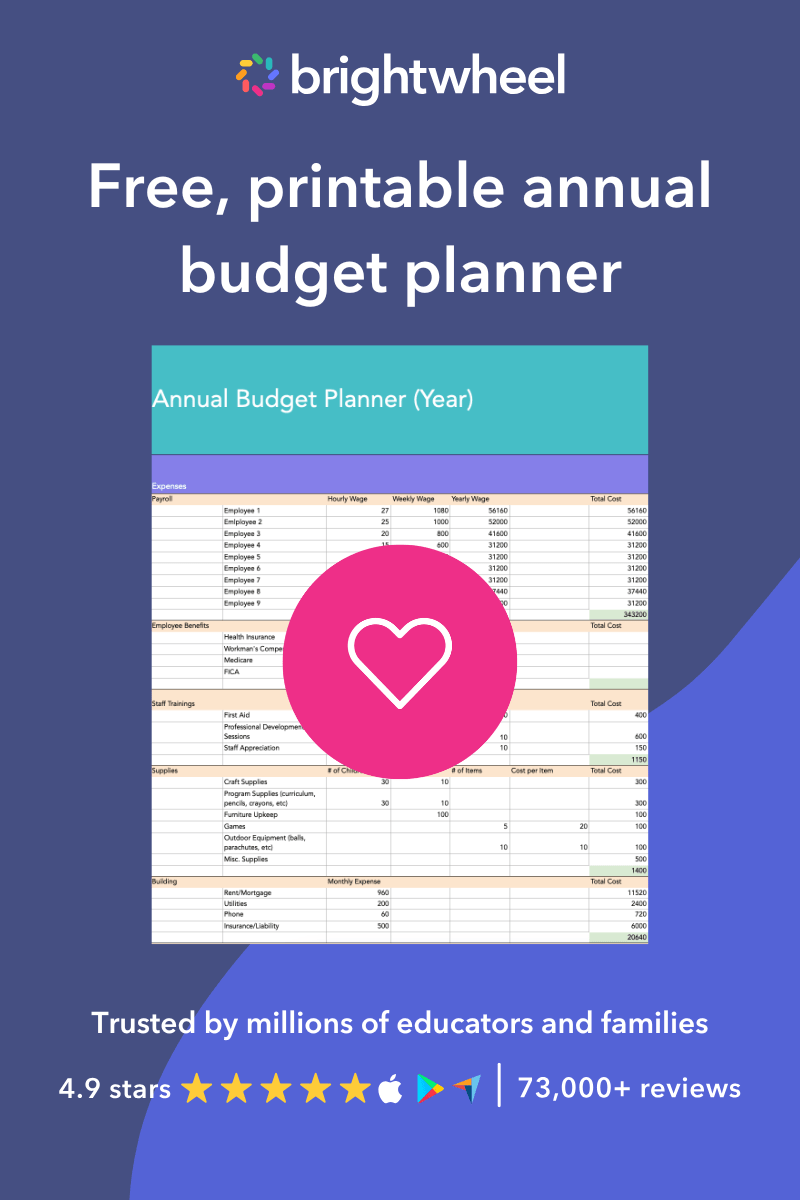

Free, Printable Annual Budget Planner

Use this planner to create a high-level budget or business plan for your childcare center.

Startup costs

Understanding your initial investment requirements prevents financial surprises during your program's launch phase. Startup costs typically fall into five major categories, each requiring careful research and planning.

Licensing and permits

State licensing fees vary significantly, ranging from $200 to $2,000 depending on your location and program size. Research your state's specific requirements early, as the licensing process can take several months. Include application fees, background check costs, and any required training certifications in this category.

Don't forget local permits such as fire department inspections, health department approvals, and zoning compliance certificates. These often carry additional fees ranging from $100 to $500 each.

Facility setup and renovation

Whether you're renovating an existing space or building new, facility costs represent one of your largest startup investments. Budget for flooring appropriate for young children, child-safe fixtures, and specialized areas like diaper changing stations and food preparation spaces.

Safety modifications including outlet covers, cabinet locks, and fencing can cost $2,000 to $5,000 for a typical facility. Plan for playground equipment if you'll provide outdoor space, with basic playground setups starting around $10,000.

Equipment and supplies

Initial equipment purchases include child-sized furniture, educational materials, toys, and safety supplies. Budget approximately $300 to $500 per enrolled child for basic furniture and supplies. This covers items like cribs, high chairs, changing tables, and age-appropriate toys.

Kitchen equipment for meal preparation adds another $2,000 to $5,000, depending on whether you'll prepare meals on-site or use a catering service. Include cleaning supplies, first aid kits, and administrative supplies in your initial inventory budget.

Insurance

Comprehensive insurance coverage protects your investment and meets licensing requirements. General liability insurance typically costs $1,000 to $3,000 annually, while professional liability coverage adds another $500 to $1,500. Property insurance varies based on your facility's value but generally ranges from $800 to $2,000 per year.

Consider additional coverage such as cyber liability insurance if you'll store family information digitally, and employment practices liability insurance once you hire staff.

Marketing and advertising

Effective marketing drives enrollment, which directly impacts your revenue stream. Allocate 5-10% of your projected first-year revenue to marketing efforts. This includes website development, print materials, social media advertising, and community outreach activities.

Professional website development costs $2,000 to $5,000, while ongoing marketing materials and advertising might require $200 to $500 monthly during your first year.

Recurring monthly expenses

Monthly operating expenses determine your program's ongoing financial sustainability. These fixed and variable costs require consistent monitoring and adjustment as your enrollment grows.

Rent or mortgage

Facility costs typically represent your largest monthly expense. Budget 15-25% of your projected monthly revenue for rent or mortgage payments. Include property taxes, maintenance fees, and any required facility improvements in this category.

Utilities

Childcare programs use significant electricity for lighting, heating, and cooling throughout extended hours. Budget $200 to $800 monthly for utilities, depending on your facility size and local rates. Include water, sewer, trash collection, phone, and internet services.

Staff salaries

Quality staff ensures program success, but payroll represents a significant ongoing expense. Budget 50-60% of your monthly revenue for staff compensation, including wages, benefits, and payroll taxes. Start with essential positions and add staff as enrollment increases.

Food and supplies

If providing meals and snacks, food costs typically run $3 to $5 per child daily. Include ongoing supply replenishment for cleaning materials, educational supplies, and consumables like diapers and wipes.

Curriculum and educational materials

Quality early childhood education requires ongoing investment in curriculum materials, books, and learning supplies. Budget $50 to $100 per enrolled child annually for educational materials and curriculum updates.

Software and technology

Modern childcare programs benefit from childcare management software that streamlines operations and improves family communication. Budget $50 to $200 monthly for childcare management software, depending on features and enrollment capacity.

As I build my new program, the billing features are a game changer. I can easily invoice parents, and everything is automatically tracked—especially helpful come tax season.” Emily K., Owner of Emily Finzen Childcare in Lake Benton, MN

Experience Curriculum allows you to lean into creativity while following the curriculum. It’s all right there, it’s all prepared for you, and then you can lean into it.” Leinani G., Owner of Creative Minds Learning Academy in Bothell, WA

I would say that if you are a new program that you should definitely jump on brightwheel and just experience it. It’s tools that help make your life easier as the owner and director. There’s no reason not to, with the cost and the effectiveness, it’s 100% a yes for me.” Crystal D., Owner & Director at Lil’ Ranch Hands Family Childcare Home in Minco, OK

Brightwheel helps us in every way possible. From their onboarding and support team to the features that keep us organized, on track with planning, and communicating smoothly as a team to parents and each other. I couldn't imagine a better management system for our program." Harida H., Administrator at Play Pals Daycare in Maumee, OH

Revenue projections

Accurate revenue forecasting enables realistic financial planning and helps identify potential cash flow challenges before they become critical.

Enrollment capacity

Your licensed capacity determines maximum potential revenue. However, maintain realistic enrollment projections, especially during your first year. Most new programs reach 60-80% capacity within six months, with full enrollment typically achieved by month 12.

Tuition rates

Research local market rates to price your services competitively while ensuring profitability. Consider offering multiple payment options, including weekly, bi-weekly, and monthly plans to accommodate different family needs.

Grant and funding opportunities

Explore state and federal funding programs that support childcare providers. Many states offer startup grants or ongoing subsidies for qualifying programs. Include potential funding in your revenue projections, but don't rely entirely on uncertain funding sources.

Additional income streams

Consider supplementary revenue through after-school programs, summer camps, special events, or enrichment programs. These additional services can provide crucial income during enrollment fluctuations or seasonal variations.

Cash flow management

Effective cash flow management ensures you can meet financial obligations even when revenue fluctuates or unexpected expenses arise.

Monitoring income and expenses

Track actual income and expenses weekly during your first year. This frequent monitoring helps identify trends and allows quick adjustments to maintain financial stability. Use your budget template to compare projected versus actual figures regularly.

Setting up a reserve fund

Maintain an emergency fund covering three to six months of operating expenses. This reserve provides security during enrollment dips or unexpected major expenses. Build this fund gradually by setting aside 5-10% of monthly profit when possible.

Managing invoicing and payments

Implement clear payment policies and consistent collection procedures. Consider automated billing systems that reduce administrative time and improve payment timeliness. Many childcare management software solutions include integrated billing features.

Preparing for unexpected expenses

Budget 5-10% of monthly expenses for unexpected costs such as equipment repairs, emergency supplies, or facility maintenance. Having contingency funds prevents minor emergencies from becoming major financial crises.

Financial analysis and review

Regular financial review ensures your budget remains realistic and your program stays financially healthy throughout its first year and beyond.

Monthly budget review

Compare actual income and expenses to your projections each month. Identify significant variances and adjust future projections accordingly. This monthly analysis helps you spot trends early and make necessary operational adjustments.

Quarterly financial statements

Prepare simplified profit and loss statements each quarter to assess your program's financial health. Share these summaries with any investors or advisors who support your program.

Annual budget adjustments

Use first-year data to create more accurate projections for year two. Adjust your budget template based on actual enrollment patterns, expense trends, and revenue realities you've experienced.

Building your financial foundation

A comprehensive daycare startup budget template provides the roadmap for your childcare program's financial success. By carefully planning startup costs, accurately projecting revenues, and maintaining disciplined expense management, you position your program for sustainable growth.

Remember that budgeting is an ongoing process, not a one-time task. Regular review and adjustment of your financial plan ensures you stay responsive to changing conditions while maintaining the quality care families expect. Consider consulting with a financial advisor who understands the childcare industry to validate your projections and identify potential improvements to your financial strategy.