Childcare providers are essential partners in helping families access significant tax benefits. Form 2441 allows working families to claim the Child and Dependent Care Credit, offering savings for qualifying childcare expenses. Understanding this crucial IRS form enables providers to guide families effectively and ensure accurate reporting.

This guide provides comprehensive information on Form 2441, covering eligibility, common filing mistakes, and how childcare programs can support families during tax season while maintaining compliance.

What is Form 2441?

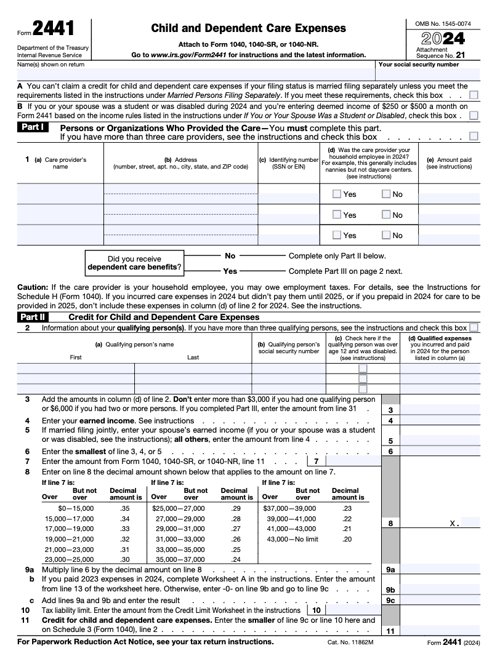

Form 2441 is an IRS tax form that allows families to claim the Child and Dependent Care Credit. This credit helps offset the costs of childcare services needed for work, job hunting, or attending school full-time.

The form requires detailed information about childcare expenses, providers, and family circumstances. Families must report their total qualifying expenses, provider information (including Tax ID numbers), and calculate their eligible credit based on income levels.

Key eligibility requirements include:

- Work requirement: Both spouses must work, look for work, or attend school full-time (with limited exceptions)

- Child age limits: Children must be under 13 years old or dependents unable to care for themselves

- Provider information: Complete details about each childcare provider must be included

- Expense documentation: Receipts and records of all qualifying childcare payments

2025 tax year updates

For the 2025 tax year, several important changes affect Form 2441:

- Maximum qualifying expenses remain $3,000 for one child and $6,000 for two or more children

- Credit percentages continue to range from 20% to 35% based on adjusted gross income

- Income thresholds for credit calculations have been adjusted for inflation

Understanding tax credits vs. deductions

Form 2441 provides a tax credit, not a deduction. Credits directly reduce your tax liability dollar-for-dollar, making them more valuable than deductions. For example, a $1,000 credit reduces your taxes by exactly $1,000, while a $1,000 deduction only reduces taxable income.

Who can file Form 2441?

Not every family qualifies for the childcare tax credit. Understanding eligibility requirements helps determine whether Form 2441 benefits apply to your situation.

Income limits for 2025

The Child and Dependent Care Credit is available to families at all income levels, but the credit percentage decreases as income increases:

- 35% credit: Families with adjusted gross income up to $15,000

- Sliding scale: Credit percentage decreases by 1% for each $2,000 of income above $15,000

- 20% credit: Families with adjusted gross income above $43,000

Filing status requirements

Form 2441 is available to families with these filing statuses:

- Married filing jointly (both spouses must meet work requirements)

- Single parents who work or attend school

- Head of household filers with qualifying dependents

- Married filing separately (limited circumstances only)

Eligibility checklist

Use this checklist to determine if you qualify for Form 2441:

✓ You paid for childcare to enable work, job searching, or school attendance✓ Your child is under 13 or a dependent unable to provide self-care

✓ You have complete provider information including Tax ID numbers

✓ You maintained detailed expense records throughout the year

✓ Both spouses worked during periods when care was provided (if married)

Common Tax Write-Offs for Childcare Businesses

Maximize your tax savings with this free guide.

How childcare programs can help families with Form 2441

Childcare programs play a crucial role in helping families successfully claim their childcare tax credits. Proper documentation and clear communication make tax season easier for everyone involved.

Streamline tax document preparation

Modern childcare management systems like brightwheel simplify tax season preparation. Brightwheel's automated billing features track all family payments throughout the year, generating accurate tax statements with digital signatures for compliance.

The platform automatically calculates total payments and organizes information by tax year, eliminating manual record keeping errors.

Maintain accurate payment records

Accurate record keeping throughout the year prevents tax season headaches. Brightwheel's billing dashboard provides real-time payment tracking, ensuring all transactions are properly documented. The system generates detailed payment histories that families need for Form 2441, while automated receipt delivery confirms each transaction.

Provide essential provider information

Families need specific information about their childcare providers to complete Form 2441:

- Program name and address: Complete legal business information

- Federal Tax ID number (EIN): Required for all providers except individuals who earned less than $600

- Total payments received: Accurate annual payment totals by family

- Service dates: Clear documentation of care periods

Brightwheel automatically includes this information on year-end tax statements, reducing administrative burden for both programs and families.

Communicate tax requirements early

Proactive communication helps families prepare for tax season. Send reminder emails in January explaining Form 2441 requirements and when tax statements will be available. Include information about accessing tax documents through your parent portal and provide contact information for questions.

Common mistakes to avoid with Form 2441

Many families make preventable errors when filing Form 2441. Understanding these common mistakes helps ensure accurate filing and maximum tax benefits.

Claiming ineligible expenses

Not all childcare-related expenses qualify for the tax credit. Common ineligible expenses include:

- Overnight camps: Day camps qualify, but overnight camps do not

- School tuition: Regular school costs don't qualify, but before/after school care does

- Transportation costs: Getting to and from child care isn't covered

- Food and supplies: Meals and diapers provided by families aren't qualifying expenses

Incorrect calculations

Form 2441 requires precise calculations based on income levels and family size. Common calculation errors include:

- Using wrong income thresholds for credit percentages

- Applying incorrect expense limits ($3,000 for one child, $6,000 for two or more)

- Miscalculating the earned income limitation

- Double-counting expenses claimed by both spouses

Missing required information

Incomplete forms delay processing and may result in credit denials. Essential information includes:

- Complete provider Tax ID numbers for all childcare arrangements

- Accurate total payments to each provider

- Proper dependent information and ages

- Both spouses' earned income (if married filing jointly)

Frequently asked questions about Form 2441

Here are some commonly asked questions regarding Form 2441:

Who is eligible for Form 2441?

Working families with children under 13 or dependents unable to provide self-care can file Form 2441. Both spouses must work, look for work, or attend school full-time (with limited exceptions for married couples filing jointly).What expenses qualify for childcare tax credits?

What expenses qualify for childcare tax credits?

Qualifying expenses include payments to licensed childcare programs, registered family childcare providers, day camps, and before/after school programs. Expenses must be necessary for work or school attendance and cannot exceed your earned income.

How do I know if I am eligible for childcare tax credits?

You're likely eligible if you work and pay someone to care for your child under 13 while you're at work. Both spouses must meet work requirements if married filing jointly. Your childcare provider must give you their Tax ID number, and you must maintain payment records.What information do I need from my childcare provider for Form 2441?

You need your provider's complete name, address, and Tax ID number (EIN). You also need the total amount paid during the tax year and confirmation of service dates. Licensed childcare programs typically provide this information on year-end tax statements.

What if my child has multiple childcare providers?

You must report information for each provider separately on Form 2441. This includes individual Tax ID numbers, payment amounts, and service periods for each arrangement. Total all qualifying expenses when calculating your credit, but don't exceed the annual limits.

What if I made an error on Form 2441?

File an amended tax return using Form 1040X if you discover errors after filing. You have three years from the original filing deadline to claim missed credits. Keep all supporting documentation and consult a tax professional for complex situations.

Can I file Form 2441 electronically?

Yes, Form 2441 can be filed electronically as part of your complete tax return using tax preparation software or through a tax professional. Electronic filing is faster, more secure, and provides quicker confirmation of receipt than paper filing.

What happens if my provider doesn't have an EIN?

Individual providers who earned less than $600 from your family don't need to provide an EIN—you can use their Social Security Number instead. However, most licensed childcare programs have EINs. Contact your provider directly or check with your program administrator if you're missing this information.

Maximize your childcare tax benefits

Form 2441 offers valuable tax savings for working families, but proper preparation and accurate filing are essential. Understanding eligibility requirements, maintaining detailed records, and avoiding common mistakes ensure you receive the maximum credit available.

Childcare programs that invest in comprehensive billing systems like brightwheel make tax season significantly easier for families. Automated record keeping, accurate payment tracking, and compliant tax statement generation reduce administrative burden while helping families claim their full benefits.

This article is designed to provide general information regarding the subject matter covered. It is not intended to serve as legal, tax, or other financial advice related to individual situations. Because each individual's legal, tax, and financial situation differs, specific advice should be tailored to the particular circumstances. For this reason, you are advised to consult with your own attorney, CPA, and/or other advisors regarding your specific situation.